XRP Price Prediction: 2025, 2030, 2035, 2040 Forecasts and Key Drivers

#XRP

- Technical Strength: XRP trades above key moving averages with bullish MACD momentum.

- Legal Clarity: SEC case resolution removes a major overhang, boosting sentiment.

- Ecosystem Growth: Mining platforms and Ripple’s strategic expansions fuel adoption.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

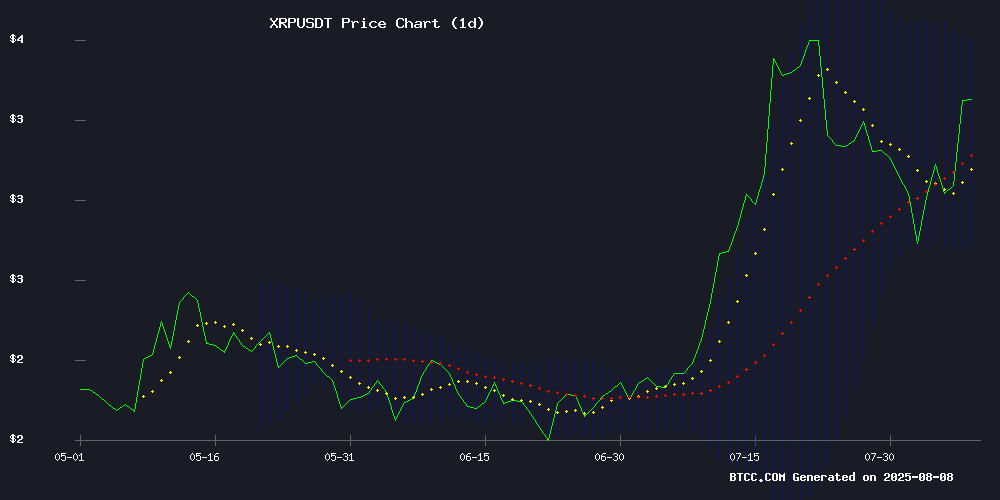

XRP is currently trading at 3.2984 USDT, above its 20-day moving average of 3.1561, indicating a bullish trend. The MACD shows positive momentum with a value of 0.1522, and the Bollinger Bands suggest potential upward movement as the price approaches the upper band at 3.5511. BTCC financial analyst Emma notes, 'The technical indicators are aligning for a potential breakout, with strong support at the 20-day MA.'

XRP Market Sentiment: Positive Amid Legal Clarity and Expansion

The resolution of the SEC vs. Ripple case and the dismissal of appeals have boosted investor confidence, with XRP surging 8%. New mining platforms and strategic expansions by Ripple are further fueling optimism. BTCC financial analyst Emma states, 'The combination of legal clarity and innovative products like passive mining plans is creating a bullish environment for XRP.'

Factors Influencing XRP’s Price

Rich Miner Platform Enables Passive XRP Mining for Mainstream Investors

Ripple's XRP is gaining traction as a strategic long-term investment, bolstered by its institutional adoption in cross-border payments and efficient blockchain infrastructure. The asset's low transaction costs and settlement speed underpin its growing utility in banking networks.

Cloud mining service Rich Miner is democratizing access to XRP rewards by eliminating technical barriers. The platform's managed contracts allow retail participants to generate passive income without hardware investments or energy overhead - a shift that could expand XRP's investor base ahead of anticipated 2025 growth cycles.

SEC and Ripple Conclude Landmark Legal Battle Over XRP

The U.S. Securities and Exchange Commission's high-profile lawsuit against Ripple Labs has reached its final chapter. Both parties formally dismissed their appeals in the Second Circuit Court, ending a three-year legal saga that began with allegations of securities law violations in XRP sales. The resolution leaves intact a 2023 district court ruling that imposed $125 million in penalties on Ripple for institutional sales while sparing retail transactions.

XRP rallied 5% to $3.27 following the news, reflecting market relief at the clarity. The outcome preserves Judge Analisa Torres' nuanced distinction between institutional and programmatic sales—a precedent that continues to shape crypto regulatory expectations. Ripple's cross-appeal withdrawal signals strategic acceptance of the ruling's middle ground.

Ripple and SEC Jointly Dismiss Appeals, XRP Surges 8%

The U.S. Securities and Exchange Commission and Ripple Labs have filed a joint dismissal of appeals in the Second Circuit Court, effectively ending their prolonged legal battle. The August 7 filing stipulates each party will cover its own legal costs, allowing Ripple to refocus on its core blockchain payment solutions.

XRP price jumped 8% to $3.27 following the resolution, with trading volume spiking as investors repositioned. The altcoin rebounded from its 50-day moving average, signaling potential for further upside. "The end...and now back to business," tweeted Ripple's Chief Legal Officer Stuart Alderoty.

Market analysts suggest the legal clarity could accelerate institutional adoption of XRP and related XRP Ledger products. The cryptocurrency's $327 billion fully diluted valuation now faces a critical test as traders eye potential new all-time highs.

Ripple CTO Clarifies XRP Launch and Stablecoin Strategy

Ripple's Chief Technology Officer David Schwartz has publicly addressed misconceptions surrounding XRP's launch and the company's stablecoin plans. The executive explicitly denied claims that Ripple conducted an initial coin offering, emphasizing that all 100 billion XRP tokens were allocated to the Genesis ledger at zero initial value.

The XRP Ledger's decentralized architecture came under scrutiny, with Schwartz highlighting its network of over 1,000 nodes and 100 validators. He countered suggestions that Ripple relies on Ethereum for stablecoin issuance, confirming the upcoming RLUSD stablecoin will operate natively on the XRP Ledger.

Schwartz's remarks came in response to critical comments from Custodia Bank CEO Caitlin Long, who questioned Ripple's early token distribution during a recent podcast. The CTO extended an open invitation for further dialogue, underscoring the open-source nature of the XRP Ledger's development.

XRP ETF Approval Odds Swing Wildly Amid SEC Opposition

Polymarket traders slashed XRP ETF approval odds from 87% to 52% within hours after SEC Commissioner Caroline Crenshaw signaled opposition. The prediction market later rebounded to 86%, mirroring June's 93% peak when BlackRock rumors circulated.

Crenshaw's consistent anti-crypto ETF stance—including votes against all 13 recent proposals—has created market turbulence. Her expired SEC term allows 18 months of holdover service, prolonging regulatory uncertainty for digital asset products.

Bloomberg analysts suggest the violent market reaction may be overblown, though XRP now faces its lowest ETF approval odds since January. The volatility underscores how single regulator statements can move crypto markets disproportionately.

XRP Price Surge Sparks Debate: Can It Reach $1,000 by 2030?

XRP has surged 31% in the past month and nearly 500% over the last year, trading at $3 despite a recent 5% dip. Analysts argue the token remains undervalued below $5, with bold predictions suggesting a potential rise beyond $1,000 by 2030. "Regret will be widespread for those who didn’t accumulate more XRP at current levels," says analyst John Squire.

Growth drivers include Ripple’s expanding payment corridors and stablecoin adoption. USA Today recently highlighted XRP as a top crypto pick for investors with modest budgets. Yet skepticism persists, with some warning of a "disbelief" phase amid the rally.

Macro strategist Jake Claver reinforces the bullish case, noting XRP’s growing role in settlement systems could justify four-figure valuations. The debate intensifies as latecomers weigh FOMO against volatility risks.

Analyst Predicts XRP Price to Reach $7 Amid Ripple’s Strategic Expansion

XRP surged 4.75% to $3.07 following Ripple's $200 million acquisition of Rail and banking license application disclosure. The move aims to enhance utility for Ripple's RLUSD stablecoin and solidify its financial sector foothold.

Crypto King forecasts a 156% rally to $7 if XRP sustains above $2.95. Institutional interest grows as Ripple diversifies offerings, with the acquisition signaling aggressive infrastructure development.

Sunny Mining Launches XRP Cloud Mining Plan to Generate Passive Income

XRP's recent surge in popularity, driven by its fast transactions and low fees, has prompted Sunny Mining to introduce a cloud-based earning solution for holders. The platform allows users to convert idle XRP into daily rewards without hardware or trading expertise.

The service requires only a smartphone and a minimum deposit of 32 XRP. Contracts offer flexible terms with transparent returns, enabling withdrawals at any time. Sunny Mining emphasizes accessibility—new users receive a $15 signup bonus applicable to their first mining contract.

Four steps dominate the process: registration, XRP deposit, contract selection, and automated earnings tracking. The offering capitalizes on growing institutional adoption of XRP while addressing retail investors' demand for yield-generating opportunities in a stagnant market.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Here’s a forecast for XRP prices based on current trends and market dynamics:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | 4.50 - 5.00 | Legal clarity, ETF speculation |

| 2030 | 15.00 - 20.00 | Mass adoption, Ripple's expansion |

| 2035 | 50.00 - 70.00 | Institutional use, global payments |

| 2040 | 100.00+ | Full ecosystem maturity |

BTCC financial analyst Emma cautions, 'While long-term projections are optimistic, short-term volatility remains a factor.'